The Logistics Industry Is Worried About Digitalization and Is Looking for the Right Approach

- Electric mobility, software, the environment: customized solutions expected "with free delivery"

- Industry sees a need for action, particularly in matters of environmental protection

- Continental Mobility Study makes clear that intense cost pressure in the sector leaves little room for innovations with lasting effect

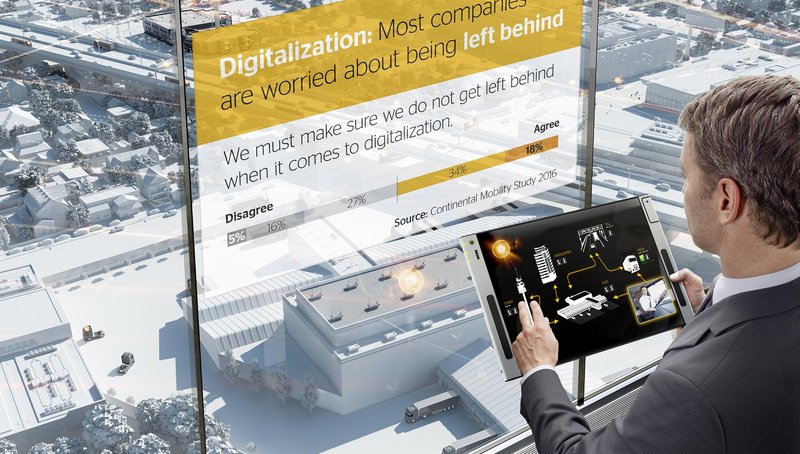

Hanover, September 2016. Competition, environmental specifications, digital technologies, new players in the transport business, a lack of qualified drivers – logistics companies are not short of challenges, as the Continental Mobility Study 2016 shows. More than half of the logisticians surveyed in the study fear that their industry could get left behind as digitalization progresses. A third believe that the digital transformation is having no effect on the transport business. A fifth see no opportunities for the sector in digitalization. Meanwhile, 9% of logisticians even say that they cannot think of anything relating to digitalization happening yet.

Throughout the study, the industry experts consistently recognize the necessity and added value of innovative software solutions. However, they see a major challenge in using blanket network coverage to ensure that data can be shared, intelligently linking data, providing data in real time, and safeguarding both data protection and simple, intuitive operability. The experts surveyed also believe that it is important for providers to offer uniform, suitable standards and compatibility irrespective of the manufacturer.

"We expect neutrality and universal applicability. That incorporates being open to other manufacturers as well", says a logistics expert quoted in the study. The criticism is that at present, there are too many different solutions and systems on the market, leading to a lack of clarity and to excessive strain. "For us, that means that we have to make our own adjustments and find a software solution for every customer. The attempt to standardize a wide range of transport management software failed catastrophically," says another expert.

Of the German logisticians surveyed, 82% regard a further significant challenge to be the European Union's ambitious climate targets to be met by 2030 and the associated ongoing tightening of environmental specifications. "I have no electric mobility whatsoever. It exists only in the form of converted vehicles. Electric mobility would make a lot more sense in the truck segment than in passenger cars," comments one expert in the study. "Aerodynamically, the current vehicles are like a barn door. Why can't trucks extend a nose cone or spoiler once they get on the freeway? The side mirrors should be dispensed with and replaced with cameras," says another expert.

At the same time, in their role as operational users, professional drivers are not especially open to innovation. According to the survey, the topics of software and connectivity have little to do with drivers' professional realities. For 23% of drivers, the topic of vehicle connectivity plays no role whatsoever. Meanwhile, 40% regard automated driving as entirely unimportant to the future of their industry, rising to 41% for platooning (slipstreaming or drafting).

The study suggests that the entire industry is working to capacity as a result of tough competition and, in its own view, has barely any resources to commit to innovation. The experts say that the situation is particularly difficult for small and medium-sized transport companies. Moreover, innovations need to pay off within just one or two years if companies are to survive the competition.

There is an additional challenge: well-trained drivers are a scarce commodity, with fierce competition from central and eastern European EU countries. The suggestion that competition for drivers is intensifying is confirmed by 91% of German logistics experts surveyed. "It is easier to find a lawyer than a driver," as one expert puts it. In China, 74% of respondents are witnessing increasing competition for drivers.

There is general concern in the industry that there is even greater competition on the horizon (84%). By contrast, only 27% regard it as a major challenge that new players such as online retailers are shaking up the logistics market. "There are already endless competitors in Germany and in many other markets. A distinction needs to be made here, in that drivers and vehicles can make a significant contribution, so there is a distinction in the sense of a high-quality service," as one fleet manager describes his approach in the study.

With the "Mobility Study 2016 – The Connected Truck," leading technology company Continental is presenting what is now its fourth mobility study. The Market and social research institute (infas) surveyed logisticians, forwarding agents, fleet operators, and long-haul drivers in Germany and China. The focus was on the challenges faced by the logistics sector as a result of digitalization and connectivity.

Facts and figures regarding the challenges facing the logistics industry

- At 44.3%, the lion's share of logistics costs can be attributed to transport. Overall costs in the logistics market in Europe amounted to approximately €960 billion in 2014.

Source:http://de.statista.com/statistik/daten/studie/72704/umfrage/verteilung-der-logistikkosten-in-europa/ - From 681,000 trucks in 1960, the number of trucks registered in Germany was more than four times that figure in 2016, at 2,801,000.

Source: http://de.statista.com/statistik/daten/studie/6961/umfrage/anzahl-der-lkw-in-deutschland/ - In total, more than 1.8 million commercial vehicles were sold in the EU in 2014. The number of commercial vehicles weighing up to 3.5 metric tons rose from 1,535,287 in 2014 to 1,713,850 in 2015.

Source: http://de.statista.com/statistik/daten/studie/76120/umfrage/anzahl-der-verkaeufe-von-nutzfahrzeugen-in-der-eu/

- Transport Industry in the Digital Price Trap

- Competition, Cost Pressure, Scarce Funds: Challenging Conditions for the Logistics Industry

- The Logistics Industry Is Worried About Digitalization and Is Looking for the Right Approach

- Logistics Sector Urgently Awaits Innovative Electric Mobility Solutions from Manufacturers

- Automated Driving Still a Long Way off for the Logistics Industry

- Logistics Industry Wants Clearly Structured Software Solutions Instead of a Software Jungle

- Working as a Trucker: Day-to-Day Mixture of Dream Job and Self-Exploitation