Strong Growth: Automotive Electronics Business Provides a Boost for Continental

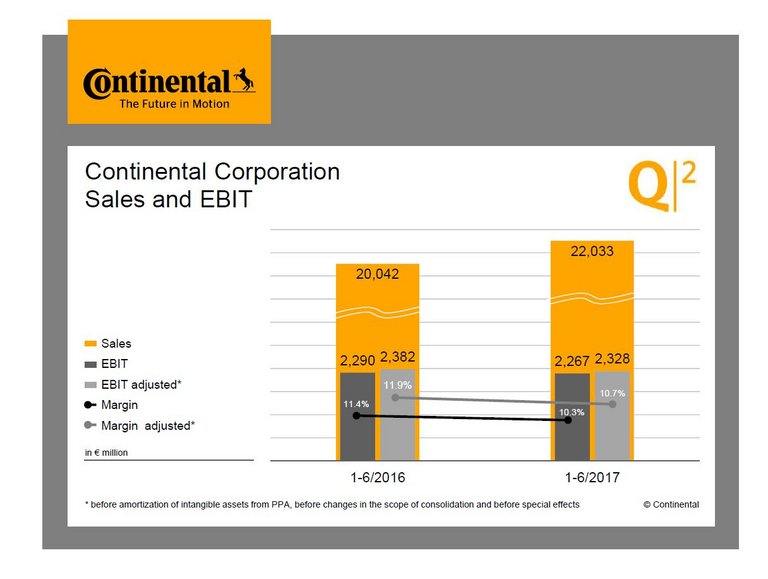

- Sales rise by 10 percent to €22 billion in first half of 2017

- Sales projection for year as a whole increased to more than €44 billion, earnings outlook confirmed

- Order intake for the Automotive Group increased to more than €19.5 billion after first six months

- Operating result down slightly year-on-year at €2.3 billion as a result of sharp increase in raw material prices for the Rubber Group

Hanover, August 3, 2017. Technology company Continental is raising its sales forecast for the current fiscal year again on the basis of good half-year figures. “Our business with innovative technologies for assisted and automated as well as with connected and efficient driving once again grew faster than the global market for passenger cars and light commercial vehicles. Sales growth in this area came to 10 percent. For this reason, we are raising our forecast for the corporation’s sales by €500 million to more than €44 billion,” said Dr. Elmar Degenhart, Continental’s chairman of the Executive Board, on Thursday at the presentation of the business figures for the first six months of the year. The order intake for the Automotive Group totaled more than €19.5 billion after the first six month.

“Our Tire and ContiTech divisions also increased their sales by more than 9 percent altogether, including the contribution of the Hornschuch Group, which has been consolidated in the ContiTech division since March. With regard to earnings, the headwind in both divisions increased as expected as a result of sharp increases in raw material costs, which had a negative impact of €300 million on the Rubber Group’s earnings in the first half of the year,” said Degenhart, explaining the half-year results for the Rubber Group. However, Degenhart expects the price increases, mainly for natural and synthetic rubber, to decline again over the second half of the year. Overall, the technology company anticipates a total negative impact of approximately €450 million as at the end of the year. This is €50 million less than the amount forecast at the beginning of the year.

In Degenhart’s view, the half-year results confirm the expectations for the current fiscal year: “We are reiterating our earnings outlook and are pleased to be able to increase our sales forecast thanks to the growth momentum in the automotive business. We are confident that the Rubber Group’s contribution to earnings in the second half of the year will be higher than in the previous year again.” Degenhart continues to regard the market environment as challenging. “Economic and political uncertainties are notably influencing market activities. Over the past few years, we have further improved our agility and flexibility – and we are now benefiting from this,” he added.

Chief Financial Officer Wolfgang Schäfer was satisfied with the company’s sound sales growth and its financial position. “Our increased capital expenditure takes account of our strong growth,” said Schäfer, explaining the increase in capital expenditure on property, plant and equipment and software. This item rose by 26 percent to €1.16 billion in first six months of 2017. As a result, the capital expenditure ratio amounted to 5.3 percent after 4.6 percent in the comparative period of the previous year.

Free cash flow before acquisitions after the first six months of the year amounted to €531 million and was thus €510 million lower than in the previous year. “This deterioration was attributable to higher investments in the expansion of development and production capacity and to the increase in working capital associated with the strong growth. Compared with the same period of the previous year, we posted an increase in working capital of €300 million. In addition, there were payments for warranty cases of more than €120 million. However, provisions had already been recognized for this in 2016,” explained Schäfer. With regard to the outlook for the year, he added: “We are still confirming our target of free cash flow before acquisitions of about €2 billion for the current fiscal year”.

In the first half of 2017, research and development expenses increased by 9.5 percent year-on-year. This increase almost matched the percentage rise in sales. In relation to consolidated sales, the ratio of research and development expenses, like in the comparative period of the previous year, came to 7.2 percent.

The Continental Corporation’s net indebtedness amounted to €3.47 billion at the end of the first half of the year. The main reason for the increase compared to the first quarter of 2017 was the dividend payout for fiscal 2016 of more than €850 million in May 2017. Compared to the end of 2016, net indebtedness increased by €671 million. The gearing ratio fell to 22.8 percent at the end of June 2017 (previous year: 25.8 percent). The equity ratio was at 41 percent. As at June 30, 2017, Continental had a liquidity buffer of €4.9 billion, comprising €1.8 billion in cash and cash equivalents and €3.1 billion in committed, unutilized credit lines.

As at the end of the second quarter of 2017, the corporation had more than 230,000 employees, around 10,000 more than at the end of 2016. In the Automotive Group, the number of employees rose primarily in production and in research and development. Overall, there was an increase of more than 4,700 employees here. In the Rubber Group, further expansion of production capacity and sales channels, as well as the acquisition of the Hornschuch Group, led to an increase of more than 5,600 employees. Compared with the reporting date for the previous year, the total number of employees in the corporation was up by more than 15,600.

In the first six months of this year, the Automotive Group achieved sales of €13.4 billion. The adjusted EBIT margin was 8.4 percent (comparative period of the previous year: sales of €12.2 billion, adjusted EBIT margin of 8.0 percent).

In the first half of 2017, the Rubber Group generated sales of €8.6 billion. The adjusted EBIT margin was 15.1 percent (comparative period of the previous year: sales of €7.9 billion, adjusted EBIT margin of 18.5 percent).

Click here for key figures - jpg (112KB) of the Continental corporation.