Continental Increases Sales Forecast for Current Fiscal Year after Successful Start

- Organic sales growth of 9.5 percent to €11 billion in first quarter of 2017

- Sales projection for 2017 raised to more than €43.5 billion

- EBIT of more than €1.1 billion / EBIT margin of 10.3 percent

- Net income rises to €750 million or €3.75 per share

- Automotive Group: Organic sales grow 11 percent – considerably faster than the market

- Rubber Group: Negative effects from increased raw material costs of €100 Million

Hanover, May 9, 2017. Continental has made a successful start to the new fiscal year. Based on this strong growth, the technology company is raising its sales projection for the year as a whole to more than €43.5 billion: “We can look back on a strong first quarter in terms of sales and earnings. Our three Automotive divisions in particular made an important contribution to the pleasing sales growth. For the second quarter, we anticipate a continued strong performance. We are therefore raising our sales projection for the current year by €500 million to more than €43.5 billion. At the same time, we are aiming to comfortably achieve an adjusted EBIT margin of 10.5 percent for the year as a whole,” said Continental Chairman of the Executive Board Dr. Elmar Degenhart on Tuesday at the presentation of the business figures for the first quarter of 2017.

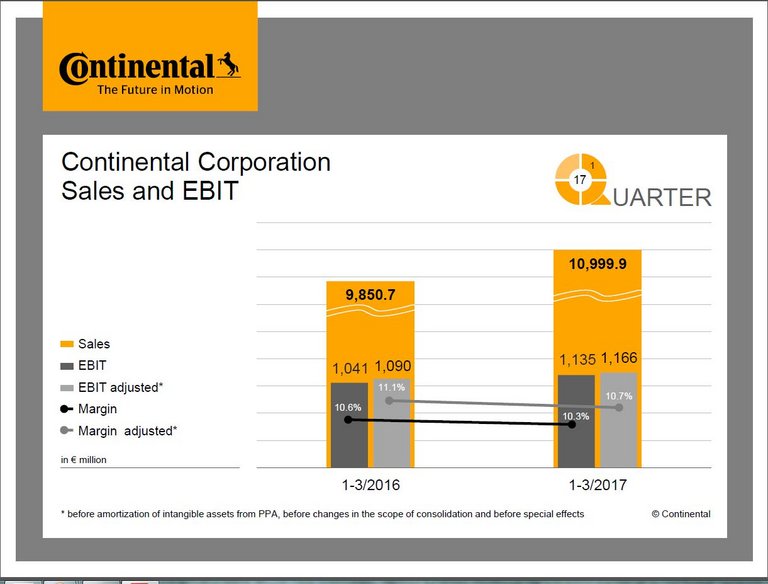

In the first quarter of 2017, the international automotive supplier, tire manufacturer and industrial partner boosted its sales by 11.7 percent year-on-year to €11 billion. Organic sales growth, i.e. adjusted for changes in the scope of consolidation and exchange rate effects, came to 9.5 percent. At the same time, net income attributable to the shareholders of the parent rose by 2.1 percent to €750 million. Earnings per share thus rose to €3.75 after €3.67 in the same period of the previous year.

As at March 31, the operating result (EBIT) had increased by 9.1 percent year-on-year to over €1.1 billion. This equates to a margin of 10.3 percent compared with 10.6 percent in the previous year.

The adjusted operating result (adjusted EBIT) climbed to just under €1.2 billion, representing an increase of 7.0 percent compared with the first quarter of 2016. At 10.7 percent, the adjusted EBIT margin was 0.4 percentage points lower than the level for the first three months of the previous year. This was mainly due to the sharp increase in raw material prices.

The Automotive Group increased its sales by 12.4 percent to €6.8 billion in the first quarter of the current fiscal year. Adjusted for changes in the scope of consolidation and exchange rates, sales growth came to 11.3 percent.

“Demand for our innovative electronics and software solutions for safe, efficient and intelligent driving remains consistently high. Incoming orders from automotive manufacturers worldwide rose to more than €9.5 billion in the first quarter. With an adjusted EBIT margin of 8.4 percent, we are also fully on track,” said Schäfer.

In the Rubber Group, sales climbed by 10.6 percent year-on-year to €4.3 billion in the first quarter of 2017. Adjusted for changes in the scope of consolidation and exchange rates, the sales increase came to 6.9 percent.

“Strong demand for passenger car and truck tires and for products from ContiTech’s Mobile Fluid Systems and Benecke Kaliko Group business units resulted in encouraging growth in our Rubber Group in the first quarter of 2017. At the same time, negative effects from rising raw material prices increased to €100 million as expected. The adjusted operating result therefore decreased to 15.1 percent. We also expect to see rising raw material costs in the second quarter. However, their impact on earnings should decrease in the second half of 2017 as a result of the price adjustments already introduced,” affirmed CFO Wolfgang Schäfer.

Compared with the end of the previous year, Continental reduced its net indebtedness by €30 million to a total of just under €2.8 billion in the first quarter of 2017. The gearing ratio thus came to 17.6 percent. “Continental has a very solid financial position. Digitalization, electrification and automation – these are the topics driving the radical change in the industries in which we operate. We can act from a position of strength,” emphasized CFO Wolfgang Schäfer.

Free cash flow after the first three months amounted to €133 million and was thus €356 million lower than in the previous year. By contrast, free cash flow before acquisitions only decreased by €203 million. “The decrease in free cash flow before acquisitions this quarter is a natural consequence of our very strong growth. Key factors here include the increase in working capital and the rise in investments. These investments in new production capacity secure our future growth,” explained CFO Wolfgang Schäfer.

As at March 31, 2017, Continental had a liquidity buffer of just under €5.8 billion, comprising almost €1.9 billion in cash and cash equivalents and almost €3.9 billion in committed, unutilized credit lines. The negative net interest result totaled €84 million in the first three months of 2017. The increase of €50 million was chiefly attributable to valuation effects and changes in exchange rates. “At €34 million, interest expense resulting from bank borrowings, capital market transactions and other financing instruments was roughly equivalent to the prior-year figure. The major portion related to expense of €21 million from issued bonds,” said Schäfer.

In the first three months of the year, Continental invested a total of €503 million in property, plant and equipment, and software. As a result, the capital expenditure ratio amounted to 4.6 percent after 4.0 percent in the comparative period of the previous year. Continental increased its research and development expenses to fund the start of numerous projects. Compared with the first quarter of 2016, this figure went up by 9.0 percent to €781 million. This corresponds to a ratio of 7.1 percent of sales after 7.3 percent in the comparative period of the previous year.

At the end of the first quarter, Continental had 227,565 employees, which was 7,428 more than at the end of 2016. In addition to the first-time consolidation of the Hornschuch Group, this was primarily due to further increases in production capacity, expansion of sales channels, and increased activities in the field of research and development.