“The Connected Truck” – Continental Study Reveals a Need for Action in Digitalization

- Transport companies fear falling behind in digitalization

- Critical attitude to automated driving persists

- The future of the transport sector: environmental protection gaining momentum

- Still the biggest challenges: cost pressure and driver shortages

Schwalbach, Germany, June 2021. There is growing concern among German transport companies that they could fall behind in digitalization. This is a key finding of the study “The Connected Truck,” carried out by the renowned social research institute infas on behalf of the technology company Continental. Through this study, Continental is taking a hard look at trends and developments in the transport industry for the second time since 2016. German trucking companies, logistics specialists and transport companies were surveyed on topics such as digitalization, automation, vehicle technologies and general conditions in the industry. Two other important findings: Environmental protection is rapidly becoming more important in the transport industry, and the logistics specialists surveyed see new players in transportation as another future challenge. An overview of all results can be found here (PDF, 508,9 KB) - pdf (509KB).

Digitalization is changing the industry – and logistics experts see a need for action

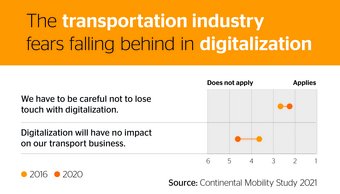

In terms of digitalization, a clear image emerges in the study results. Many of the logistics professionals who were surveyed (an even larger proportion compared with 2016) stated that digitalization has already greatly changed the industry. Although the opportunities presented by digitalization are perceived positively by some of the logistics companies, fear of “missing the boat” is the predominant feeling among the respondents – and that feeling has grown slightly in direct comparison with the results of the preceding 2016 study. “The transportation industry is in the midst of a major transformation process. The players have seen that digitalization has continued to accelerate in recent years, and now they see a need for action that will position them solidly for the future,” says Gilles Mabire, Head of the Commercial Vehicles and Services (CVS) Business Unit at Continental.

Skepticism about automation persists, satisfaction with software on the rise

The logistics experts surveyed still take a critical view of automation in the transport industry. Compared with the 2016 study results, the number of those who are particularly skeptical or positive about automated driving has fallen slightly at both ends of the scale. However, only a small minority of the study participants still believe that automated driving offers opportunities for the industry or drivers. The study does have good news for the industry’s IT and telematics service providers: logistics companies are clearly more satisfied today with the software they are using. Compared to the 2016 study results, the respondents gave consistently better marks to software solutions that support drivers, dispatchers and fleet managers.

Vehicle connectivity is also becoming an increasingly important topic for the future, especially for larger fleets. “Commercial vehicles are now the most connected vehicles anywhere. Logistics experts are looking for solutions that will make the best use of new technologies for them,” says Mabire. “Transport and fleet companies have already had experience with relevant software solutions, and they appreciate the gain in efficiency. The immediate benefits outweigh the distant vision of autonomous driving.” The industry’s attitude will hardly change as long as automated driving remains an abstract concept in discussions. “Only when the legal framework becomes clearer and the first projects in automated zones such as port terminals or in hub-to-hub logistics show that automation can bring a very tangible benefit to companies will automated driving gain supporters,” he says.

Growing challenges: New competitors enter the market

What are the biggest challenges for the industry? As in the 2016 survey, increasing cost pressure and the competition for well-trained drivers continue to feature prominently as the top two future challenges. The almost unanimous expectation is a further tightening of the prevailing conditions. However, logistics experts also see new challenges ahead for the industry. Just under half of those surveyed fear that new players will intensify the competitive situation in the transport industry. “Large shippers and online retailers that used to be customers of the transport companies are now building their own logistics infrastructures. The result of this is that logistics companies are not only losing their existing customers, but new players are entering the market,” notes Mabire. In the study results, the logistics experts attribute greater importance to these new competitors than to shipping or rail transport.

Environmental protection gains relevance

The topic of the environment has meanwhile become much more important. Compared to the previous survey in 2016, environmental protection gained the most importance among the future challenges surveyed. “Due to the global discussions about climate change, the logistics industry simply cannot push this topic aside. This study result also reflects specific policy measures, such as EU legislation to reduce CO2 emissions from heavy transport, that are having a real impact on the industry. The big questions are how much the issue will be regulated by politics in the future and how logistics companies will act in terms of investment decisions,” says Mabire. “If shippers’ willingness to invest in environmental protection doesn’t increase, policymakers must focus on incentives to ensure the transport industry does its part to achieve climate change goals.”

About the study

Between February and May 2020, the infas Institute for Applied Social Science surveyed the first and second management levels of small, medium-sized and large companies in the German logistics and transport industry, including trucking companies and logistics and transport companies. However, the scope of the study was reduced due to the Covid-19 crisis. A total of 45 companies took part in the survey, the results of which can be taken as an indication of trends.

Christopher Schrecke

Media Spokesperson Safety and Motion

Continental Automotive